ERP User satisfaction study paper 2020: crash of IFS

A few days ago Trovarit AG published its latest study paper: the ERP user satisfaction study 2020. This study has been conducted for many years now. It provides insights how ERP solutions as well as the partners are perceived. A current and historical comparison between the applications is possible.

In recent years, IFS Applications has become a competitor to well-known applications such as SAP, Microsoft Dynamics365 or Infor. It has been sold as feature-rich, lean and user-friendly. The "One Stop Shop Approach" was particularly attractive for customers. One of the companies’ USPs was that IFS produced and implemented the solution itself and also provided the maintenance services.

2BCS AG has been supporting their customers with ERP implementation projects for many years now and gained valuable experiences in this field. In recent years the ERP solution of IFS was part of many evaluation projects. Well-known companies such as Emhart Glass, Uster Technologies or Carlo Gavazzi successfully implemented the ERP solution. However, IFS also had to cope with setbacks.

Historical development and customer satisfaction

The current study shows that customer satisfaction with IFS has changed significantly. Compared to the study results of 2018, there seems to be a crash for IFS in 2020. Can this crash be seen as one-time thing or does it show a trend? 2BCS AG has analyzed customer satisfaction with IFS over the last ten years and identified the following three phases:

In recent years, IFS Applications has become a competitor to well-known applications such as SAP, Microsoft Dynamics365 or Infor. It has been sold as feature-rich, lean and user-friendly. The "One Stop Shop Approach" was particularly attractive for customers. One of the companies’ USPs was that IFS produced and implemented the solution itself and also provided the maintenance services.

2BCS AG has been supporting their customers with ERP implementation projects for many years now and gained valuable experiences in this field. In recent years the ERP solution of IFS was part of many evaluation projects. Well-known companies such as Emhart Glass, Uster Technologies or Carlo Gavazzi successfully implemented the ERP solution. However, IFS also had to cope with setbacks.

Historical development and customer satisfaction

The current study shows that customer satisfaction with IFS has changed significantly. Compared to the study results of 2018, there seems to be a crash for IFS in 2020. Can this crash be seen as one-time thing or does it show a trend? 2BCS AG has analyzed customer satisfaction with IFS over the last ten years and identified the following three phases:

- 2010 – 2015: Customer satisfaction was rather bad. The solution was not fully developed and customers were not satisfied with IFS as a partner at all.

- 2015 – 2018: The solution was rated significantly better. Also the satisfaction with IFS as a partner greatly improved.

- 2020: The solution was rated worse, the satisfaction significantly worse.

How could this crash happen? Insights into the consulting practive of 2BCS AG, particularly into the implementation projects with IFS as solution, could help to find the reasons.

Reasons for the crash in 2020

Based on the consulting business and experiences of the 2BCS AG, the following reasons can be identified for this crash:

-

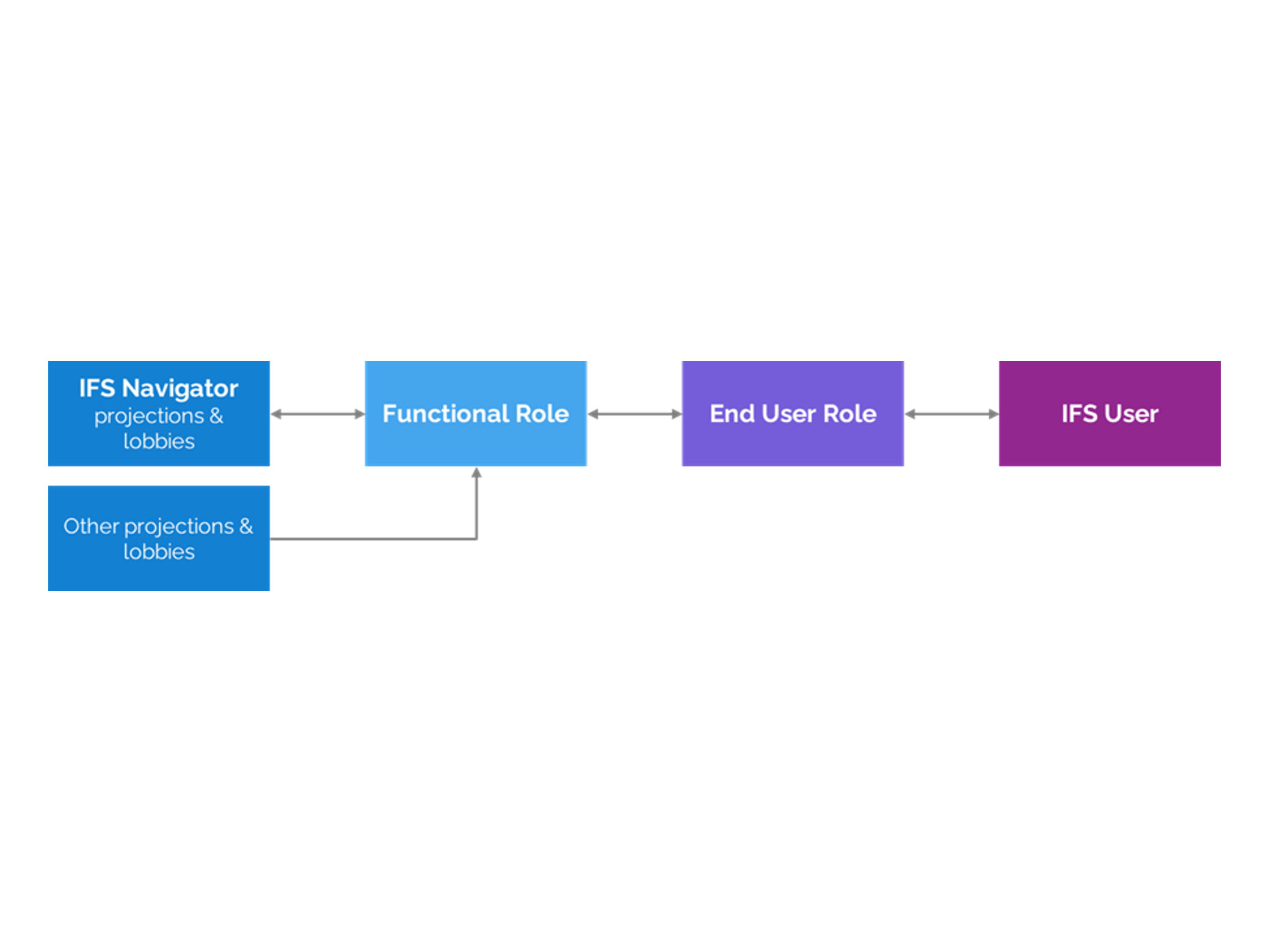

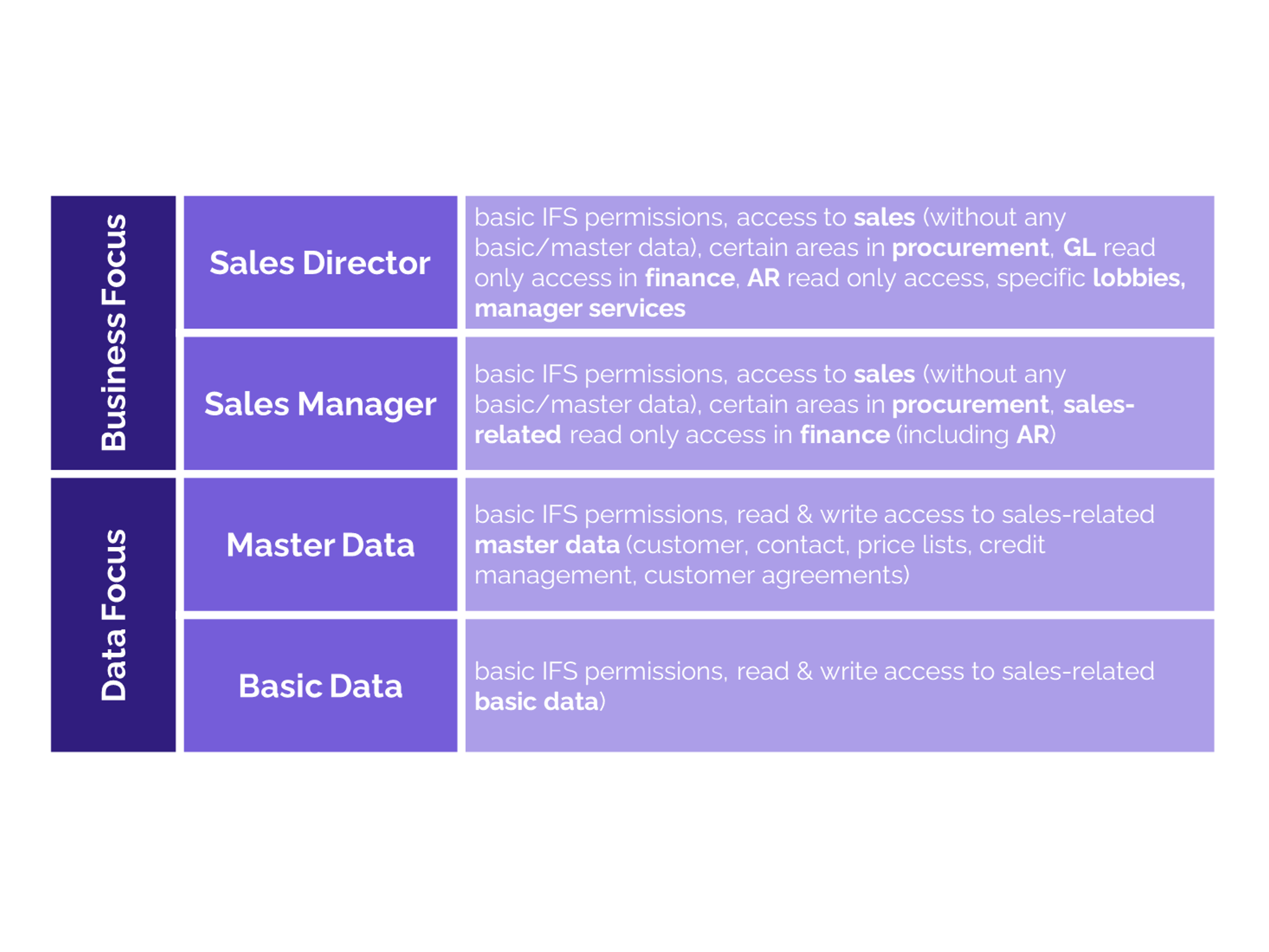

Change of business model

Since 2018 IFS tries to build up a partner-eco-system with IFS as the main supplier of the solution and partner companies for related services. Some companies from central Europe, such as Bytics or Eqeep have been established as System Integrator (SI) partners for this solution. However, this separation means changes for the customers. They have to deal with new contact persons and possibly a lack of skills. Also, direct access to IFS development is missing. In addition, there are different interests of IFS and its partners: IFS wants to sell licences and maintenance, the partners their services.

-

Growth of IFS and the cloud business

The turnover of IFS has increased by 25 % per year. Staff and knowledge development could not keep up with this. As a result, many new consultants were hired without extensive IFS experience, which could not always meet the customers’ expectations. The cloud business also experienced significant growth. Also, about 50 % of IFS’ new contracts are sold as cloud solution. Compared to IFS, other well-known ERP suppliers such as SAP or Microsoft have more experience in the cloud field. The growth and the associated new challenges lead to problems such as missing resources, a lack of know-how and inadequate management. End customers are aware of these problems and punish IFS with an inadequate assessment.

-

Aurena

More than two years ago IFS announced its innovative user interface Aurena. Improved handling and mobility should contribute to a new user experience. However, there are currently few experienced consultants for projects with Aurena, although IFS sales representatives actively promoted this user interface. The Know-how is obviously missing as all implementation projects supported by 2BCS consultants were carried out without Aurena.

-

Goodbye to newcomer image

Not long ago, IFS was known as an outsider among ERP solutions. More than that, it was a bold alternative to other well-known applications. For several years now, however, the company has been trying to position itself as equal competitor to SAP. The newcomer image is gone and as a consequence, expectations of IFS as a solution and partner have increased.

Apart from these, there are certainly other reasons with a significant negative impact on the user satisfaction with IFS. In our opinion, the easiest way to improvement is to expand resources and skills of consultants and the cloud team quickly and sustainably.

Who is 2BCS?

2BCS AG was founded in 2006 with offices in St. Gallen and Zürich. The company, solely owned by Dr. Martin Brogli, offers process-oriented, independent consulting services for digitalization. 2BCS AG creates application strategies, carries out evaluations in the ERP, CRM and MES environment and offers implementation services. To date, more than 250 medium-sized industrial and commercial enterprises in Switzerland and abroad have been advised. According to NZZ, 2BCS AG is the largest and most successful independent evaluation and implementation consulting company in Switzerland. The secrets of success are competent consultants contributing their knowledge, experiences and skills to the customers.

Since 2018 IFS tries to build up a partner-eco-system with IFS as the main supplier of the solution and partner companies for related services. Some companies from central Europe, such as Bytics or Eqeep have been established as System Integrator (SI) partners for this solution. However, this separation means changes for the customers. They have to deal with new contact persons and possibly a lack of skills. Also, direct access to IFS development is missing. In addition, there are different interests of IFS and its partners: IFS wants to sell licences and maintenance, the partners their services.

The turnover of IFS has increased by 25 % per year. Staff and knowledge development could not keep up with this. As a result, many new consultants were hired without extensive IFS experience, which could not always meet the customers’ expectations. The cloud business also experienced significant growth. Also, about 50 % of IFS’ new contracts are sold as cloud solution. Compared to IFS, other well-known ERP suppliers such as SAP or Microsoft have more experience in the cloud field. The growth and the associated new challenges lead to problems such as missing resources, a lack of know-how and inadequate management. End customers are aware of these problems and punish IFS with an inadequate assessment.

More than two years ago IFS announced its innovative user interface Aurena. Improved handling and mobility should contribute to a new user experience. However, there are currently few experienced consultants for projects with Aurena, although IFS sales representatives actively promoted this user interface. The Know-how is obviously missing as all implementation projects supported by 2BCS consultants were carried out without Aurena.

Not long ago, IFS was known as an outsider among ERP solutions. More than that, it was a bold alternative to other well-known applications. For several years now, however, the company has been trying to position itself as equal competitor to SAP. The newcomer image is gone and as a consequence, expectations of IFS as a solution and partner have increased.

Contact us